RealVitalize: Goodbye Stress, Hello Earnings

Homes are flying off the market just as quickly as they are listed, but sellers can still miss out on getting top dollar if they decide not to upgrade – or upgrade poorly. Additionally, from upgrades to inspection and moving costs, the entire process can be overwhelming for the seller. Coldwell Banker recently commissioned a survey, conducted by The Harris Poll, exploring the difficulties of the home selling and buying process as well as the challenges around home renovations during those processes.

The survey found:

- 89% who have sold their homes in the past three years reported that they made upgrades before selling.

- Over a quarter (28%) of those who have renovated their homes in the past three years were unsure how to get the most out of their improvements.

- Gen Zers and Millennials were more likely to say they struggled to find the money to make updates (34% and 31%) compared to Gen Xers and Boomers (14% and 4%).

- One in five homeowners (21%) said that they plan to sell their current home in the next 12 months.

Thankfully Coldwell Banker affiliated real estate agents can help sellers get the best value for their homes with RealVitalize, a program that allows home sellers to make improvements and repairs with no upfront costs. With more than 20 years of real estate experience, Rose Sklar of Coldwell Banker Realty is an expert at using RealVitalize to help her clients maximize their sale price. Below, we share some of her best tips for anyone hoping to take advantage of the program.

TIP #1 – Advise your clients: Talk to your agent first.

Americans of all generations are taking advantage of making upgrades to get more bang for their buck – 89% who have sold their homes in the past three years reported that they made upgrades before selling. However, 28% said they had the money to make updates before listing but struggled to understand the best updates to make to get the most return on investment.

Here’s where Rose and RealVitalize come in. With two decades of real estate knowledge, she has insight into the must-haves in renovation and upgrades because she sees what sells the fastest and what doesn’t. She follows the latest design trends to coach her clients on what buyers want – updated landscaping, minimalist furniture, modern cabinet knobs (“Spend some $$ here!” she says) and the most neutral wall colors. Then she’s able to help them take advantage of RealVitalize and the program’s network of home professionals to make those upgrades.

“I come into my clients’ homes before listing, and they tell me they just had fresh painting done. However, it’s often the wrong color – sometimes an ‘off’ cream that’s actually mustard, or a bright color that only they like. I always advise them – wait until your real estate agent weighs in before you start making updates,” counsels Rose.

Clients upgrading their homes is great – but only if they make the right upgrades. Utilizing the power of before and after photos, Rose and her team demonstrate the strength and potential that the RealVitalize program holds.

TIP #2: Inspect before you list.

Rose always recommends doing an inspection prior to listing. Fixing issues before potential buyers even walk through the door saves yourself and the client much added stress, those “what-if’s” and the possibility of the buyer asking for a price reduction when problems inevitably pop up.

Pre-inspections can also lessen the disconnect between the seller’s list of must-dos and the must-haves of potential homebuyers. According to our survey, features that would be must-haves for Americans if they were looking to buy a home include kitchen upgrades (45%), bathroom upgrades (44%) and updated HVAC, plumbing and electrical (43%). RealVitalize can help with updates – and convincing clients to perform a pre-inspection is easy when they understand the money doesn’t come out of pocket for these repairs.

TIP #3: Less Is More!

“Less is more!” says Rose, noting that home sellers often have trouble parting with beloved belongings. She understands their attachment, however, and shows empathy when working with these clients. However, when she shows them before and after pictures, that’s when they really start to understand how much more they could make if they use RealVitalize to pay for storage, hire moving and packing crews and bring in staging services.

While moving and storing items is stressful – according to our survey, among those who sold a home in the last three years, three fifths (61%) say it is at least somewhat stressful to move and store items – as Rose says, “It’s about helping clients realize: You can do this with RealVitalize.”

TIP #4: Sitting stale? RealVitalize.

Rose does her best to convince all her clients to use the RealVitalize program, whether they have big or small updates to make. “Gentle encouragement” is what she calls it.

Some clients can take more convincing, which is why Rose sometimes has to resort to a two-stage model in her encouragement approach. Stage 1 is listing without any upgrades and listing the house as-is. If the house sits stale on the market – which it almost always does, she notes – then she tells her client it’s time to move to stage 2. During the second stage, upgrades are made and new photos are taken. Once the house is relisted, she says she often sees the home close in record time.

Every client won’t understand right away the importance of renovations – but when RealVitalize is added to the picture, it makes agents’ jobs easier.

Goodbye Stress, Hello Earnings

From the first step out of the car, up the walkway to the front door, Rose knows that first impressions matter to potential buyers. The good news is, gone are the days of wondering what upgrades to make. Coldwell Banker affiliated agents guide sellers from start to finish – and when sellers use RealVitalize, high earnings, less stress and quick turnaround are almost guaranteed. A clean kitchen, a freshly painted door and killer landscaping can set potential buyers up for a wonderful walkthrough, potentially leading to a done deal at the end of the showing.

Wedding or Homeownership? Unmarried Americans Would Prefer to Invest in a Home, According to Coldwell Banker Survey

Latest Coldwell Banker survey gauges homebuyer and seller sentiments in 2022

MADISON, N.J. (November 17, 2021) – Americans pressed pause on many milestones in 2020, but in 2021 they reignited plans to buy and sell homes. The real estate market is strong according to the National Association of Realtors® and homeownership is top of mind for Americans. In fact, 82% of unmarried Americans would rather invest in a home than pay for a big expensive wedding, according to the latest survey from Coldwell Banker Real Estate LLC, a Realogy (NYSE: RLGY) company.

Conducted online by The Harris Poll among over 2,000 U.S. adults, the survey reveals what’s on home buyers’ and sellers’ minds as we close out a strong year for real estate in a market marked by tight inventory. A sellers’ market still prevails and competition remains strong across many cities, especially as younger Americans enter the real estate market and various demographics set their sights on homeownership.

Who’s Got Real Estate on their Mind?

- Gen Z & Millennials are moving on up: Younger Americans surveyed (age 18-44) are more likely to say owning a home is an important financial goal for them (45%) compared to those 55+ (30%).

- Goodbye renting, hello homeownership: 47% of Respondents who are renters say “owning a home” is an important financial goal for them.

- Hispanic homeownership desire is high: 42% of Americans surveyed who self-identified as Hispanic say “owning a home” is an important financial goal, and among Hispanics this is higher than any other financial goal.

As many Americans experienced life in 2020 without big vacations or weddings, Coldwell Banker Real Estate set out to discover what goals Americans would prioritize. Overall, Americans are still thinking of homeownership, indicating that they would rather allocate money to achieving those dreams than investing in other personal milestones such as big weddings, vacations or even paying off their student debt.

What Would They Be Willing to Trade for a Home?

- Home is the new engagement ring: 82% of unmarried Americans surveyed, including 85% of females who aren’t married, would rather invest in a home than pay for a big expensive wedding.

- Staycation: Over three quarters of Respondents (77%) would rather invest in a home than spend money on an expensive vacation.

- Save student debt for later: College graduates are more likely to select “owning a home” (41%) as an important financial goal than “paying off student debt” (17%).

Amid this tight housing market – and with so many Americans invested in finding the perfect home to fit their lifestyle – Coldwell Banker affiliated agents serve as trusted advisors, guiding people home since 1906.

CLICK TO TWEET:

QUOTES:

“The 2021 housing market has been marked by low inventory and competition as Americans continue to keep homeownership top of mind. Our latest survey suggests that, with generations of all ages and backgrounds prioritizing homeownership over other financial goals, this sellers’ market may continue into 2022. Our network of approximately 100,000 agents is ready to help home sellers take the next step.”

- M. Ryan Gorman, president and CEO, Coldwell Banker Real Estate LLC

“Coldwell Banker’s survey found that homeownership is a primary financial goal for 47 percent of Americans surveyed who identify as Hispanic. The U.S. Hispanic population reached more than 62 million in 2020, growing significantly in the past decade, according to the Pew Research Center. The affiliated agents at Coldwell Banker recognize this incredible potential for increasing homeownership, and they’re equipped to help this population looking for a home navigate the complexities of a tight housing market.”

- Ricardo Rodriguez, Coldwell Banker Global Luxury Ambassador, Boston, Mass.

How the “Great Resignation” is Driving the “Real Estate Renaissance”

Latest Coldwell Banker explores where Americans are moving, unveiling what the “Great Resignation” means for real estate markets across the nation.

Home is where the heart is and with the rise of Americans who no longer feel bound to one city, it’s no wonder there is a recent spark in homeownership desire across the country. According to a recent survey commissioned by Coldwell Banker, 41% of employed Americans would be willing to take a pay cut or accept a new job with a lower salary in order to move to a more affordable location.

So, who is moving and where are they headed? The survey results unveil what the “Great Resignation,” the movement of people leaving the workforce during the pandemic, means for real estate markets across the nation.

Young, employed Americans are packing their bags

According to the National Association of Realtors, home prices have dramatically increased in recent months, so it is no surprise that living in an affordable city is top-of-mind for many home seekers. In fact, younger employed Americans ages 18-44 are more likely than those 45-54 to be willing to take a pay cut or accept a new job with a lower salary in order to move to a more affordable location.

Space to grow

Homeowners, especially young adults, are noticing their own households expand, from new roommates, to living with family, to new pets. 57% of homeowners 18-34 said they have felt their housing needs impacted by a growing household in October 2021 compared with 50% in February 2021. It is no wonder many young Americans are seeking their own property and are ready to make a move.

Sunny days ahead

Young Americans are ready for the sun and they’re bringing the heat as Miami, Florida, and Austin, Texas, were revealed as two of the nation’s top cities for relocation. 31% of males aged 18-34 would consider moving to Miami while 21% of females aged 18-34 were more likely to consider relocating to Austin among the options listed.

Dreaming becomes doing

The bottom line is simple: Americans are ready to stop dreaming about homeownership and are ready to make it a reality. From Pinterest boards to Instagram inspiration, they’re looking forward to where home will be, but many still need help throughout the selling process.

The home selling process is no longer as intimidating as it may have once seemed, as just 16% of homeowners indicated that an intimidating home selling process would be a concern if they were to list their home today, compared with 20% in June 2021 and 24% in February 2021. The support and guidance from a Coldwell Banker agent can make the process that much smoother, which is why our agents across the country look forward to supporting those in search of their new home.

Americans await their new homes

From affordability to need for space, Americans have many reasons to call a new city home. Over a third of Americans (34%) indicated that they would like a program that offers benefits to a seller such as no upfront cost for renovations, instant cash offer or additional listing exposure when looking for a real estate website to use when buying or selling a home.

Coldwell Banker has great programs to aid in the home selling and buying process like the RealVitalize program, for sellers looking to sell their home faster and for a better price. RealSure Sell brings home sellers the certainty of a cash offer while they work with one of our trusted agents to find an even better offer to maximize the sale of their current home. In addition, the RealSure Buy program leaves the choice to the home seller; whether they accept the RealSure cash offer or a third-party offer, the program’s added benefits ensure they can act as if their house is sold to purchase the home they love with ease.

As household sizes expand, and the appetite from younger Americans who are willing to relocate across the country for their dream home grows, we’re here to help guide them.

9 Overlooked Items to Prep Your Home for Sale

So you’ve prepped your home cosmetically for sale in every imaginable way – fresh paint, a deep cleaning, new landscaping, decluttered closets and even organized the garage! Your house looks better then it ever has and you are ready to hit the market! Before you proceed with the “For Sale” sign in the ground, there are several key pieces of information that you should consider gathering that today’s savvy buyers are going to want to know.

Guest post by Cara Ameer

So you’ve prepped your home cosmetically for sale in every imaginable way – fresh paint, a deep cleaning, new landscaping, decluttered closets and even organized the garage! Your house looks better then it ever has and you are ready to hit the market! Before you proceed with the “For Sale” sign in the ground, there are several key pieces of information that you should consider gathering that today’s savvy buyers are going to want to know.

1. Survey

Do you have a copy of a current survey on your home? Have this document available and provide to your listing agent so they can include in the information about your home. Buyers want to know about property lines, easements, conservation buffers, if there is room for a pool, if the property line extends to the water behind your home, etc. Having a survey to provide upfront will help to eliminate these types of concerns vs. waiting until a property is under contract.

If you’ve made any changes that would affect your property such as adding a pool or fence since you took ownership and are not shown on your current survey, it’s important to advise the buyer. A new survey will usually need to be ordered prior to closing in this scenario. If you don’t have one from when you purchased the home, try contacting the title company or attorney’s office that handled the closing of the property. Depending on how long ago that was, they may be able to retrieve from their archives.

2. Floorplan or Appraisal Sketch

Buyers often need to know room dimensions as it helps with determining furniture placement and to ensure how what they have will fit (or have to be reconfigured) in the new space. As any real estate agent can attest, many hours have been spent measuring spaces while looking at a home and comparing that against the existing buyer’s furniture dimensions. I’ve encountered entire home searches that revolved around a great room accommodating an entertainment center and the garage size so a motorcycle could fit in addition to the cars!

An appraisal is helpful as it can confirm the exact square footage of a home vs. relying on tax records which may not be accurate. We’ve all heard stories where the appraisal showed the actual square footage that was smaller than what was initially represented in a listing sheet. Having an appraisal will help to ensure that does not happen. You should have received a copy of the appraisal if you obtained a mortgage loan from your lender or if you refinanced. If you don’t have either, consider having a floorplan drawn up or home measured by an appraiser when prepping your home for sale. Your agent can assist with resources to this effect.

3. Utility Bills

Buyers want to get an idea of what they can expect the heating and cooling bills to be in a home. Review your bills over the last one to two years to get an average in the various seasons, or call your local utility provider as they can often provide you with information on the high, average and low costs. This information can be very beneficial when a buyer sits down to number crunch their total costs of owning a home. If you had an unusually high or low bill, provide some explanation to accompany the numbers.

4. Termite Bond

In many markets where termites are alive and well, it is common place for homes to have some sort of protection plan in place which is also known as a bond. In Florida, where I live and work, this is a primary concern and often one of the first questions buyers and their agents want to know. Prior to listing your home, obtain a copy of your termite bond policy from the provider, know exactly what type of bond you have – repair or treatment bond and up to what dollar amount of coverage is it good for. Also know how long the bond is in effect, when it is up for renewal and what the renewal fee is, if there is a transfer fee and what does it provide protection for – not all bonds provide protection against all different types of termites.

5. Pest Control

If you maintain any type of pest control on your property, compile information as to who the provider is, what you have done, how much you pay and how often does the company come out to treat the property. A copy of your service agreement is helpful in this instance.

6. Insurance

Buyers especially want to know who a seller uses for their homeowners insurance and how much they pay. This is particularly the case in higher risk areas (where there are hurricanes, floods, fires, etc.) With homeowners insurance potentially more difficult to obtain in some areas, going through the existing seller’s insurance company can help streamline the process, particularly on an older home.

7. Product Manuals and Warranty Documents

Now is the time to gather the various product manuals for all items that will be staying in the home such as appliances, water heater, heating and cooling system, ceiling fans, pool equipment, etc. If your home came with any warranties, be sure to include these for the new owner as well. Putting all of these in one large envelope makes it easy for everything to be readily accessible in one place for the new buyer.

8. Service Providers

Compile a list of all service providers/vendors and their contact information who you have used on your home – lawn service, pool service, A/C company, etc. While a new buyer may or may not choose to use these services, they will certainly appreciate having resources available to them and may elect to initially use them as they make the transition to living in your home.

9. Covenants and Restrictions, Neighborhood Rules and Information

This is key critical information for a new owner to have on hand. A contract may likely hinge on the buyer’s review of this information, so easiest to have it available ahead of time. If you don’t have these, contact your neighborhood’s association president or management company for assistance in obtaining a copy. Many of these documents are matters of public record and are available by going online to the appropriate municipality’s website.

Work with your agent to create an informational package or binder that you can provide to prospective purchasers that come through the home with the information mentioned above. Gathering this information before you put your home on the market will save time and make the process that more efficient once you find a buyer. It may even help your home to sell faster as all of this information is available upfront, eliminating the need for guesswork and waiting on answers while another property could possibly come on the market to grab the buyer’s attention. You want to help keep the buyer focused on your home, so make it easy for them to buy by giving them what they want. Happy selling! You can read more home seller tips here.

5 Apps to Redecorate Your Home with Your Phone

Whether you’re looking to give your living room a quick refresh or want to completely revamp your home, these five apps can help you get started. Create a stunning look without blowing your budget — no professional interior designer needed.

Guest post by Lori Cunningham

With dozens of decorating apps to choose from and inspiration just a finger touch away, redecorating your home has never been easier. Augmented Reality (AR) now lets you use your phone to see how colors, accessories, and furniture will look in your own house. On the horizon, you can expect to see apps using Artificial Intelligence (AI) to learn your style through your interaction with them.

Whether you’re looking to give your living room a quick refresh or want to completely revamp your home, these five apps can help you get started. Create a stunning look without blowing your budget — no professional interior designer needed.

Houzz: Start with online inspiration

Apps like Pinterest and Instagram have plenty of pictures and designs to start your inspiration journey. However, it’s easy to get overwhelmed, and keeping track of design ideas can be cumbersome. It’s not always simple to buy an item featured in a picture, and you might need to search around to find a similar item. A site like Houzz can help you keep everything organized and in one place.

Houzz covers architecture, interior design, decorating, landscape design, and home improvement. It has over 17 million high-resolution photos, all of which can be filtered by room, style, budget, size, color, or a combination.

Many of the pictures have purchasing information on the featured items, allowing you to purchase them within the Houzz app. You can also save pictures to an “Ideabook” to help keep your style ideas all in one place.

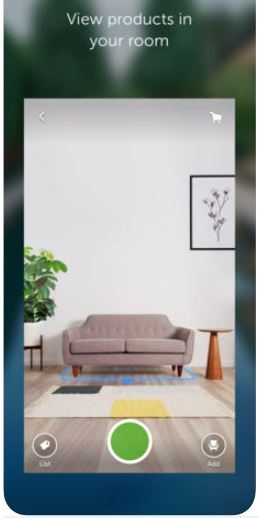

The app uses AR to help you see what an item will look like in your home. Click the “View in my room” button to see the item in 2D using your phone’s camera.

The Houzz app is free on iOS and Android.

MagicPlan: Create a floor plan from your phone

To ensure that the furniture you plan to purchase fits in the room you’d like to decorate, it helps to create a floor plan. The MagicPlan app lets you input the dimensions of a room by measuring, drawing, or using your phone’s camera to create the floor plan.

Once you’ve added your room’s dimensions, you can add doors, windows, structural features, plumbing, appliances, electrical, HVAC, furniture, flooring, and more to your floor plan. Many of these features are free to use, but there is an in-app cost for things like cabinetry, light switches, and outlets.

When you add MagicPlan’s 2D furniture, you can adjust it to the size you want by using your fingers or inputting the dimensions. You can add your own photos to your floor plan, as well.

If you are planning to paint or replace the flooring, estimate how much it would cost by clicking “Estimate” for the approximate price. Just remember the estimates do not include the cost of labor.

MagicPlan is free on iOS and Android.

TapPainter: Virtually paint your walls

Swatches from your local home improvement store make it hard to envision the color of the whole room, and buying paint samples can get expensive. The TapPainter app lets you choose paint colors from Benjamin Moore, Behr, Sherwin Williams, and other popular brands.

Use the app to snap pictures of the room you want to paint and try out different colors by entering the code from a paint swatch, choosing a color from one of the brands included, or mixing your own custom color. You can even add different colors to different walls.

TapPainter is free on iOS.

DécorMatters: Design a room using AR

DecorMatters is an app that lets you virtually add pieces and design elements to a real room. Take a picture of the room you want to decorate and use AR and the AR ruler to add and measure 3D pieces. This is a simple way to see if a piece you’ve been eyeing will fit.

The app features items from popular stores like Crate & Barrel, Target, Overstock, West Elm, IKEA, and Ashley, and you can make in-app purchases right from your phone. You can save your ideas to your mood board to share with friends, and the DecorMatters in-app messaging also offers free feedback and suggestions from real DecorMatters interior designers.

DecorMatters is free on iOS.

Art.com: Add some art to your walls

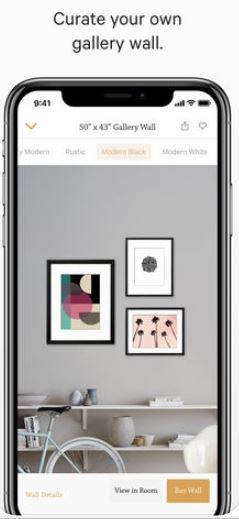

Finally, the Art.com app offers hundreds of frame styles and sizes to help you plan your gallery wall. Use the app to arrange different layouts to see how your gallery wall could look.

Art.com’s latest app release also lets you upload your own artwork and family pictures to pair with any style frame, and you can even have them printed on canvas, wood mount, acrylic, and more.

The Art.com app is free on iOS and Android.

It’s easy to create a stunning look that suits your style, all from your phone. These five apps offer the inspiration, confidence, and guidance you need to get started on your redecorating project.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link